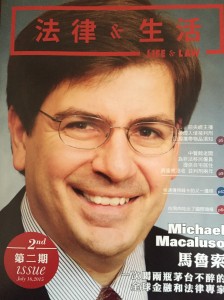

Michael Macaluso: Global finance and legal expert

Law & Life Vol. 2, July 16, 2015, cover story Michael J. Macaluso, whose Chinese name is: 马鲁索. Interview translated from the original Chinese. He is the chairman and General Counsel of Global Access and a former Partner in finance, capital markets, and investment funds at DLA Piper. He has successfully completed transactions worth more than US$100 billion for leading organizations around the globe. He was the focal point of a “Practice Spotlight” in Thomson Reuters Business Law Currents. He was also nominated to serve as a member of Thomson Reuters’ Partner Advisory Board. He represented GMAC affiliate Residential Capital during the financial crisis. He has been included in the U.S. Legal 500 list. He participated in billions of dollars/euros in financial crisis relief with global financial institutions through the U.S. government and a number of European governments. He previously served as Adjunct Professor of Law in global capital markets and structured finance at the University of Minnesota Law School. He received his J.D. and MBA from the University of Chicago. He has lived in Europe for numerous years and can speak fluent German. He visits China regularly and has many Chinese friends.

Law & Life Vol. 2, July 16, 2015, cover story Michael J. Macaluso, whose Chinese name is: 马鲁索. Interview translated from the original Chinese. He is the chairman and General Counsel of Global Access and a former Partner in finance, capital markets, and investment funds at DLA Piper. He has successfully completed transactions worth more than US$100 billion for leading organizations around the globe. He was the focal point of a “Practice Spotlight” in Thomson Reuters Business Law Currents. He was also nominated to serve as a member of Thomson Reuters’ Partner Advisory Board. He represented GMAC affiliate Residential Capital during the financial crisis. He has been included in the U.S. Legal 500 list. He participated in billions of dollars/euros in financial crisis relief with global financial institutions through the U.S. government and a number of European governments. He previously served as Adjunct Professor of Law in global capital markets and structured finance at the University of Minnesota Law School. He received his J.D. and MBA from the University of Chicago. He has lived in Europe for numerous years and can speak fluent German. He visits China regularly and has many Chinese friends.

The following is an interview of Michael J. Macaluso with one of our staff reporters

On the Chinese economy:

Ge Chen: As an expert on global finance and financial law who was involved in billions of dollars in financial crisis relief from the U.S. and European governments, how do you view China’s economic development?

Michael J. Macaluso: The Chinese economy is not a single economy. It is an extremely complex many-faceted development framework like every major economy. The Chinese economy has been very successful over the past 30 years. I believe that its greatest advantage will prove to be its ability to withstand major storms. It should not be overlooked that over this short thirty-year period, many hundreds of millions of ordinary Chinese people have joined the middle class and are able to live better lives and many have become wealthy.

Ge Chen: However, one current viewpoint claims that the distribution of wealth in Chinese society is uneven and wealth is too concentrated in the hands of a small number of people. Or “the big river floods while the small river is dry,” as they say. Ordinary people are not benefiting from this development.

Michael J. Macaluso: Time, time is the problem. Development always requires a process and process requires time. The situation in China is not unlike the situation in the United States more than 100 years ago. At that time, wealth in the U.S. was also concentrated in the hands of fewer people than it is today. However, over time, the middle class expanded as the country continued to grow economically which allowed the social development of the country to improve and the distribution of wealth to became more balanced.

It should also be noted that while developing its economy, China should also focus on educational development. Education should try to match the pace of economic development. Like software, it needs to be updated and upgraded. Education is the foundation. Furthermore, Chinese business owners must adapt their ideas and thinking and strengthen their learning to deal with the challenges brought on by operating in international markets. At Global Access, we are particularly interested in participating in this critical stage of China’s economic development.

Ge Chen: How do you view the relationship between the political and economic systems? What kind of influence does China’s political system have on its economic system?

Michael J. Macaluso: At the founding of the United States, everything was new. There were no experiences to follow in either economics or politics that were our own. Over two hundred years of development, the United States has been an interesting experiment. We continuously fumble around and experiment repeatedly to successfully develop our economy and our institutions. As for China, it is also an interesting experiment, an experiment of close cooperation between government and economics. Clearly, after the past 30 years, the mutual influence between the Chinese government and its economy has been good leading to a globally significant economy in a relatively short period of time.

Both China and the United States now face challenges. Responding to these challenges proactively will require many changes. We are currently in the middle of a remarkable decade. Technology has exerted inestimable, far-reaching effects and changes in business and life. The overall human system demands numerous changes before it can accord with such great changes.

Ge Chen: The recent drop in the Chinese stock market has had a major impact on its economic development. How do you view the volatility of the Chinese stock market? What do you think is the greatest danger to the Chinese economy?

Michael J. Macaluso: Fluctuations in the stock market are like the pulse of an economy. Fluctuations are normal. If there are no fluctuations, then that’s a big problem. If no one has any doubt in the stock market, the market is tranquil, and everyone thinks that the market is strong, then that is not a good phenomenon because risks build up below the calm surface. Stock market volatility in turn gives investors a lesson in risk. The recent fluctuations in the Chinese stock market should not be a major problem overall. Following ups and downs in the stock market, investors become more mature.

Ge Chen: The U.S. media has reported that the Chinese government’s bailing out the stock market is “protecting the market for the sake of nationalism.” If this is accurate, do you feel that this kind of approach is appropriate?

Michael J. Macaluso: I think the Chinese government wants to mitigate shareholders’ losses and guaranty a level of stability. This is a normal reaction. All governments adopt certain corresponding measures during crises. The U.S. government is always adjusting its political and economic policies to try to improve the system as a whole. During the many crises we have weathered, we have had our share of detours and sometimes suffered a great deal. But we learned and I assume China is learning. Currently, China’s newest policies and measures for the stability of the stock market have just started. It’s too early for us to judge how they might influence the stock market and economy in the future.

On Chinese companies

Ge Chen: I know that you have extensive experience representing financial institutions and corporations as an issuer, investor, underwriter, and agent in capital markets transactions within the United States and across borders. You have also served as financial counsel for a financial institution with a US$120 billion balance sheet. What are the legal issues or challenges that Chinese companies face most frequently when going abroad?

Michael J. Macaluso: Chinese companies face challenges abroad on many levels. We must first make the assumption that Chinese companies that are expanding overseas have been extremely successful domestically. These are critical companies for China. Overseas mergers and acquisitions present major challenges to the management of these enterprises, particularly senior management. Senior managers have been successful because they spent considerable amounts of time thinking about how to be successful in China. However, success in China does not mean that the same approaches and methods can be used to achieve success abroad. Therefore, Chinese companies developing overseas must not simply acquire another company and be done with it, but must learn how to be successful in different cultural environments. They must learn different national and corporate cultures. I can tell you now that this has nothing to do with how much money a Chinese company has to spend on acquisitions. It has nothing to do with money. Numerous Chinese companies engage in overseas mergers and acquisitions and are unsuccessful despite spending considerable amounts of money.

Ge Chen: Give us an example.

Michael J. Macaluso: We have a professional service called “enterprise integration after mergers and acquisitions.” This service helps two companies integrate organically and successfully. It helps them integrate their resources effectively. Although numerous Chinese companies have had successful mergers and acquisitions overseas, many still have not achieved the results they originally envisioned or expected. Therefore, the most important thing is for Chinese companies to be able to transfer the success they earned locally to the companies they acquire.

Ge Chen: Do you consider the merger of IBM and Lenovo to be successful?

Michael J. Macaluso: I consider that transaction as a successful example of a well thought out transaction and a well-executed integration.

Ge Chen: What legal challenges do Chinese companies face overseas?

Michael J. Macaluso: Every country has many laws protecting local businesses. Therefore, the first legal challenge that Chinese companies face is that the business they wish to acquire may be in some way protected by that nation’s laws, potentially preventing acquisition. For example, the national defense industry. Many companies will also encounter numerous regulations, such as food regulations, medical regulations, and financial regulations. The regulatory authorities have forests of regulatory policies and laws that must be navigated. A substantial amount of legal investigation is necessary to clarify what is permitted and what is not.

Ge Chen: What is wrong with being conspicuous and, for example doing a high profile project?

Michael J. Macaluso: Nothing is inherently wrong with that. However, practically speaking, conspicuous garners more opposition, increases time frames, draws more regulatory scrutiny and is expensive from a price perspective. Ideally, whether conspicuous or not, an acquisition should provide combined operational efficiencies and an excellent return on invested capital over time. Attention and the quality of a transaction typically are not directly proportional. If an investor conducts an acquisition or purchases real estate projects that are well known and valuable but do not draw as much public focus as something like the Empire State Building would, then the investor eliminates many legal challenges and troubles while gaining a good price.

Ge Chen: What kind of example is the purchase of the Waldorf Astoria by Chinese?

Michael J. Macaluso: The acquisition price was a bit high and the terms were very demanding.

Ge Chen: Considering the advertising effect, was it not worthwhile? Were the buyers not looking to create an advertising effect?

Michael J. Macaluso: Yes, very likely. The buyers knew that they would pay a certain price for this. Only time will tell if the return in advertising and money is sufficient.

Ge Chen: A question basically related to gambling: Some people say that the Chinese economy will collapse within ten years, whereas others say that China’s total economic output could surpass the United States’ in a few years. Who do you bet will win?

Michael J. Macaluso: I believe strongly in the tenacity of the Chinese people. This is not a competition. Within ten years, the living standards of the people of both China and the United States will improve. In particular, economic cooperation between China and the United States will contribute greatly to the future development of both countries. Everyone will gain a better life through this process.

Ge Chen: Will major conflicts occur between China and the United States during future development?

Michael J. Macaluso: No. That is not to say, however, that there could not be disagreements, even major disagreements from time to time. There may well be. Conflict is not in anyone’s interest. In particular, the close economic cooperation between China and the United States reduces political disagreements between the two countries quite a bit. Different countries will always have disagreements. Even the United States and France sometimes have major disagreements.

On his impression of China:

Ge Chen: How many times have you been to China?

Michael J. Macaluso: 100 times? Haha, too many times. The first time I went was in the 1980s. I have been to many cities. The cities I go to most frequently are Chengdu, Beijing, and Shanghai. Frankly, China is too big.

Ge Chen: What left the deepest impression on you in China?

Michael J. Macaluso: The spirit of its entrepreneurs! It seems most everyone is or aspires to be one and really wants to take business risk to earn big money. You can feel the energy in the streets. I also really like Chinese food and Chinese culture.

Ge Chen: Have you found anything fun in China?

Michael J. Macaluso: Haha, when I was in Sichuan, a friend told me that Sichuan cuisine is very spicy. I said that was no problem, I could eat something a little spicy. Then everyone ordered me a dish that was just a little spicy, mild. I ate only one bite before my entire tongue and chin went numb. I insisted that it was no problem. My Chinese hosts then decided that they had gained a good friend. There was another time, also in Sichuan, Chengdu, which also had to do with eating. Everyone was constantly shouting, “Bottoms up!” “Bottoms up!” Thus I learned that in China, if you want to drink, you need to drink Chinese baijiu.

________________

About Michael Macaluso

Michael J. Macaluso is the chairman and chief executive officer of Global Access and a former Partner in finance, capital markets, and investment funds at DLA Piper. He has a long record of success in managing large, innovative, and complex transactions for the world’s leading organizations.

(Xue Chunyang also contributed to this article)

Posted on February 4, 2016

0